A Loan Calculator is a tool that is very beneficial

for individuals who are in need of a loan to meet their needs. They can get

an idea of how much money they will be eligible for based on their personal

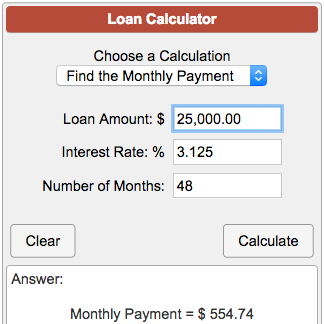

data and other factors. The calculators work by taking into consideration your

current income, estimated expenses, and the interest rate that is applicable.

These calculators were developed so that individuals who have a need for

personal loans do not have to go through too much hassle in going through

applications that could take days to be processed.

There are three types of loan calculators in the

market. One is the Mortgage Loan Calculator, which is available free of charge.

This calculator allows the users to enter information regarding their existing

home loan and the amount they need to borrow to pay it off. After this

information has been entered; the results will determine the monthly payments

and the interest rates. This calculator is very useful because it gives the

user a general idea of how much money they will be paying every month.

The next type of calculator is the Personal Loan

Calculator which is also free. This calculator can help the users to determine how

much they can borrow and at what interest rate. The details entered here will

determine the total payments and total interest payments that will be incurred

during the lifetime of the loan. In the end, this allows the user to determine

how much money they can spend or save every month with a personal loan.

The third type of calculator is the College Student

Loan Calculator. This calculator works differently from the Mortgage Loan

Calculator in that it focuses on student loans only. It requires the entering

of the interest rate, total payments, and the grace period involved with the

repayment of loans. This type of calculator is useful as it tells you how much

you can save if you choose to defer your payments. It also helps in determining

the amount of money you need to borrow during your college years.

The fourth type of calculator is the Loan Amortization Calculator, which is very helpful in calculating the entire monthly payment including the interest and other additional charges. This calculator can also help you determine the amount of monthly amortizations possible based on various factors like loan interest rate and the duration of the loan. With these calculators, you can determine the amortization schedule of your loan.

Another one of the commonly used loan calculators

is the Homebuyer's Affordability Calculator. It requires basic information

about the property you wish to purchase. This includes the price, number of

bedrooms, bathrooms, and other relevant details. This calculator can be used

for the calculation of your monthly payments, principal balance, and any other

additional costs associated with the homebuyer's package. With a homebuyer's

affordability calculator, you can easily determine the affordability of

purchasing a particular property.

Another commonly used loan calculator is the

Consumer Debt Indexed Rate calculator which allows you to determine how much

your payments would be if you were to apply for a new mortgage loan and apply

at the current interest rates. This calculator can also be used to check the

impact of recent interest rate changes on your debt. This includes the impact

of the Federal Reserve's rate cut and the rate hike announced by the Central

Banks of the United States. Using this calculator, you can see how your monthly

debt payments would change if you were to apply for a new mortgage or take out

a new loan.

Other calculators that can be used for personal loans are the Loan Principal/ Percentage Interest calculator and the Student Loan Principal/ Percentage Interest Rate calculator. For the student loan calculator, you simply need to enter the amount of money you plan to borrow and the lender's payment terms and the results will show the amount of interest you will pay and how much your monthly payments will be once the loan is completed. These calculators are a great way to get an idea of what you can afford to borrow before you talk to a lender about a personal loan.

No comments